A ‘Credit Score’ refers to a rating given by an accredited agency to a person which reflects his or her capacity and likelihood of repaying a loan. Since it is expressed as a number, it is known as a ‘credit score’. In India, the Credit Information Bureau (India) Ltd. is the premier agency responsible for issuing Credit Scores.

In order to arrive at your score, CIBIL takes into account a number of factors from your past loan and credit history. This includes:

1. Past payments on loans: Timely payments leads to a higher score, delayed payments will drag your score down. The more recent a delayed payment, the worse the score.

2. Settlements, defaults and write-offs: Any instances of non-payment of dues, even if the bank or credit card has closed their loan with you in the form of a write-off or settlement (accepting a lower amount than what you actually owed) will have a negative impact on your rating

3. Loans as proportion of income: Lower the loans against your name as a proportion of your income, the higher your score will be

4. Types of loans: Excessive credit card balances or personal loans will have a more negative impact as compared to a home loan or car loan balance

5. Too many CIBIL enquiries: If CIBIL detects a large number of enquiries for a single person, it ends up reflecting negatively, as it indicates he or she is seeking out a lot of loans.

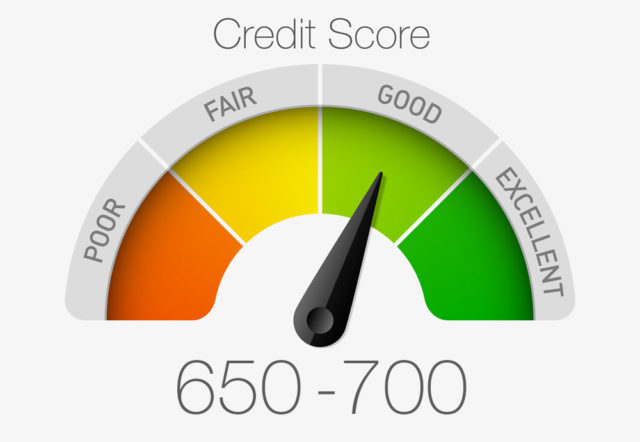

The higher the CIBIL score you have, the more likelihood of being approved for a loan from a Bank or private institution. The value of a score ranges from 300 to 900 in India. In order to understand what constitutes a ‘good’ CIBIL score, let us look at each score range and how a banker would look at it:

0 – this score indicates you do not have any credit history. No loans, no credit cards. You would not be approved for a long-term loan without a co-borrower or a guarantor. You might get a credit card if you have the income proofs.

300 – 550 – This is a poor score. It indicates a history of defaults. Chances of getting access to any new credit, whether loan or credit card, are minimal.

551 – 650 – This is borderline. It means you have delayed payments recently. Still, there should be no significant outstanding against your name and there is a good chance of being approved for new debt, especially credit cards with a low limit and small-ticket loans

651 – 750 – This is a good score, indicating that you have been regular with your payments in recent time and your loan-to-income ratio is also healthy. There is a very good chance of being approved for all types of loans and new credit cards with a healthy credit limit

751 – 900 – This is the best score you can have, indicating an established track record of access to, and prompt repayment of, credit. You should easily be able to access Bank loans at a competitive rate. Credit cards should be available with limits equal to or slightly higher than your entire monthly income and long-term loans as well.

Always remember, your score is not a fixed constant and can get better (or worse) depending on your financial behaviour. It is entirely possible that some early financial mistakes may have happened, but given time and discipline, you can improve your score and get it back to a respectable level.